Service: Tax Assessor

Tax Assessor

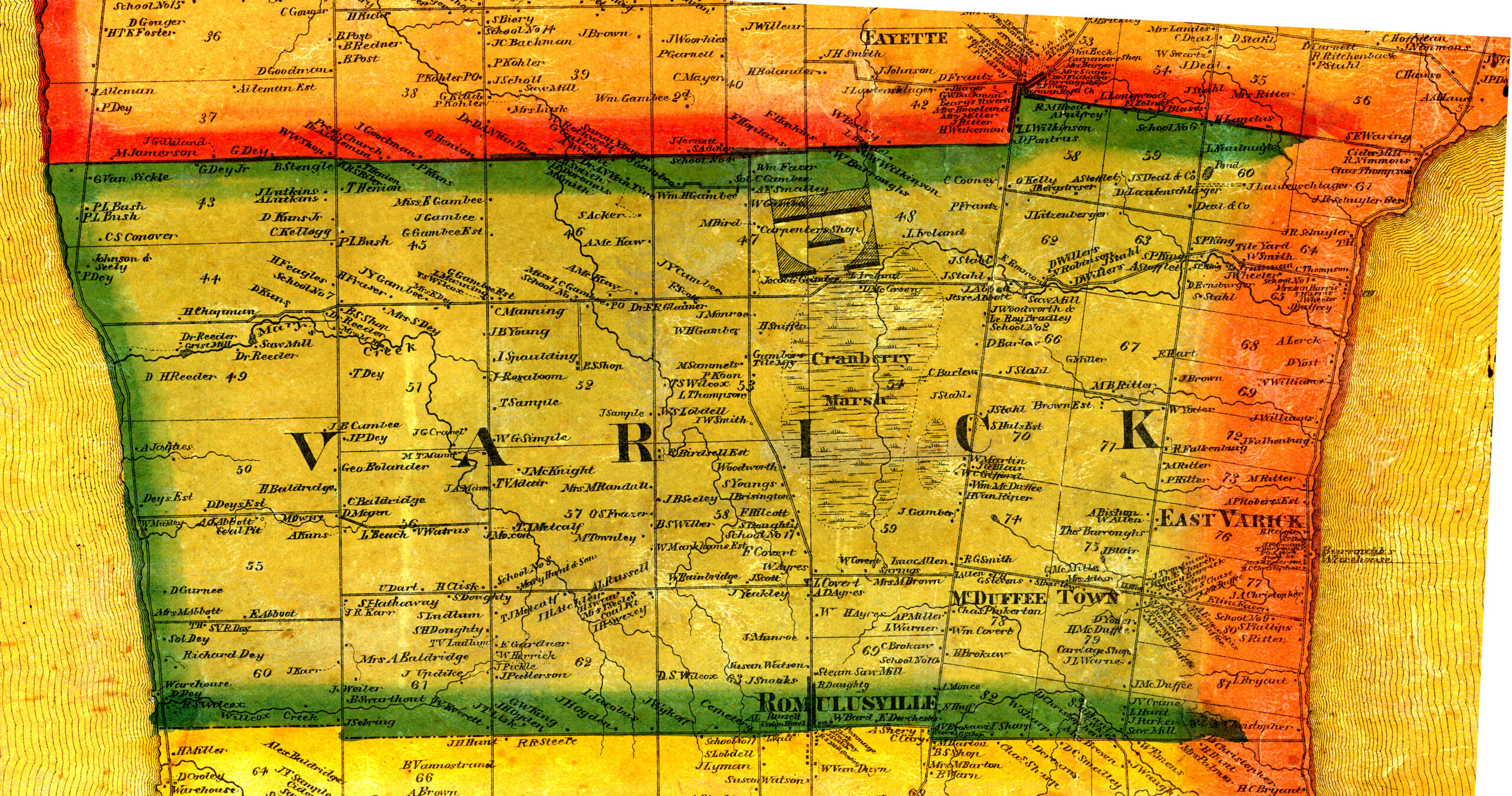

The Assessor estimates the value of each real property parcel within Varick. This value is converted into an assessment, which is one component in the computation of property tax bills.

The assessment is used for both municipal (Town and County) and school taxes.

If property owners feel that the assesment is inaccurate, they can appeal through the Assessment Review Board on a specific date in May.

The assessor does not determine how much taxes are to be paid. That determination is made by the Town Board as part of the budget process.

Who Do I Contact?

The primary contact for the Tax Assessor is:

Anne Morgan

Tax Assessor

Phone: 607-869-9689

Fax: 607-869-9254

clorv@fltg.net